How to Write a Check: Step-by-Step Guide

Estimated reading time: 3 minutes, 8 seconds

In the digital age, writing checks may seem like an outdated practice, but it remains a relevant and essential skill. Whether you’re paying the rent, splitting the bills, or contributing to a fundraiser, knowing how to write a check is an essential life skill. In this guide, we’ll break down the process into simple steps, ensuring you fill out your check correctly every time.

Check Basics

Before diving deeper into the step-by-step guide, let’s understand the basic components of a check. A check typically has fields for date, payee, amount in words and figures, memo, and your signature. Each of these elements plays a vital role in ensuring that the check is valid and can be processed seamlessly by the banks.

Step by Step Guide

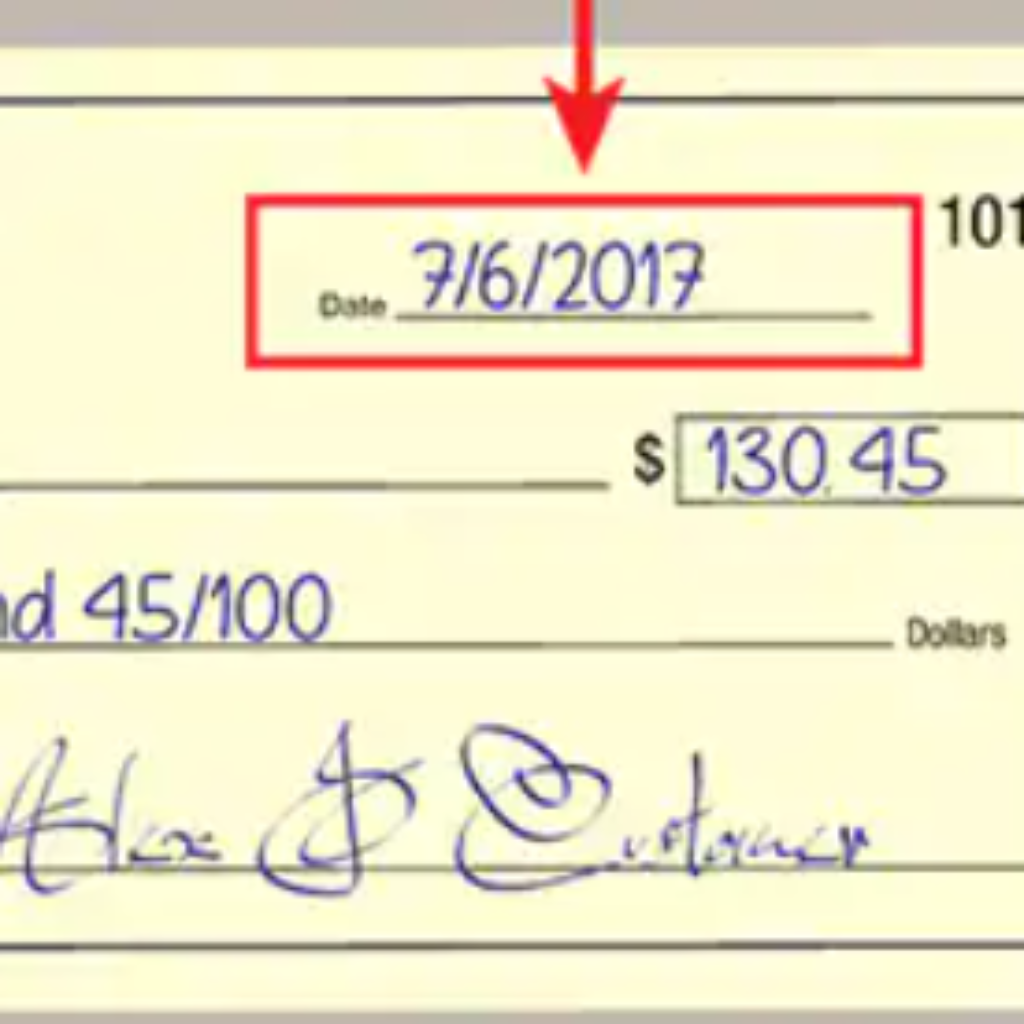

Write date

Start by filling out the date field in the upper right corner of the check. Make sure the date is current and reflects the day you are writing the check.

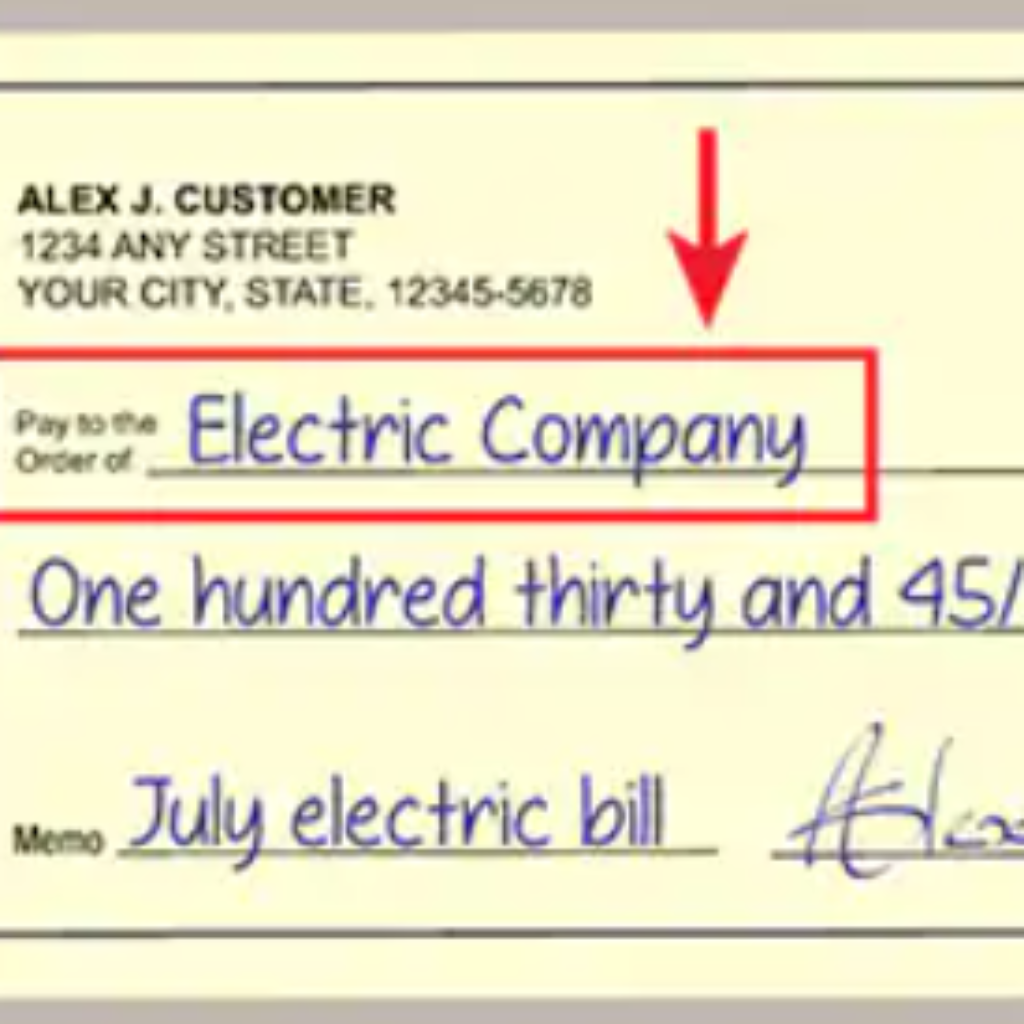

Identifying the payer

Clearly write the name of the person or entity to whom you are making the payment. Accuracy is important here to avoid any ambiguity.

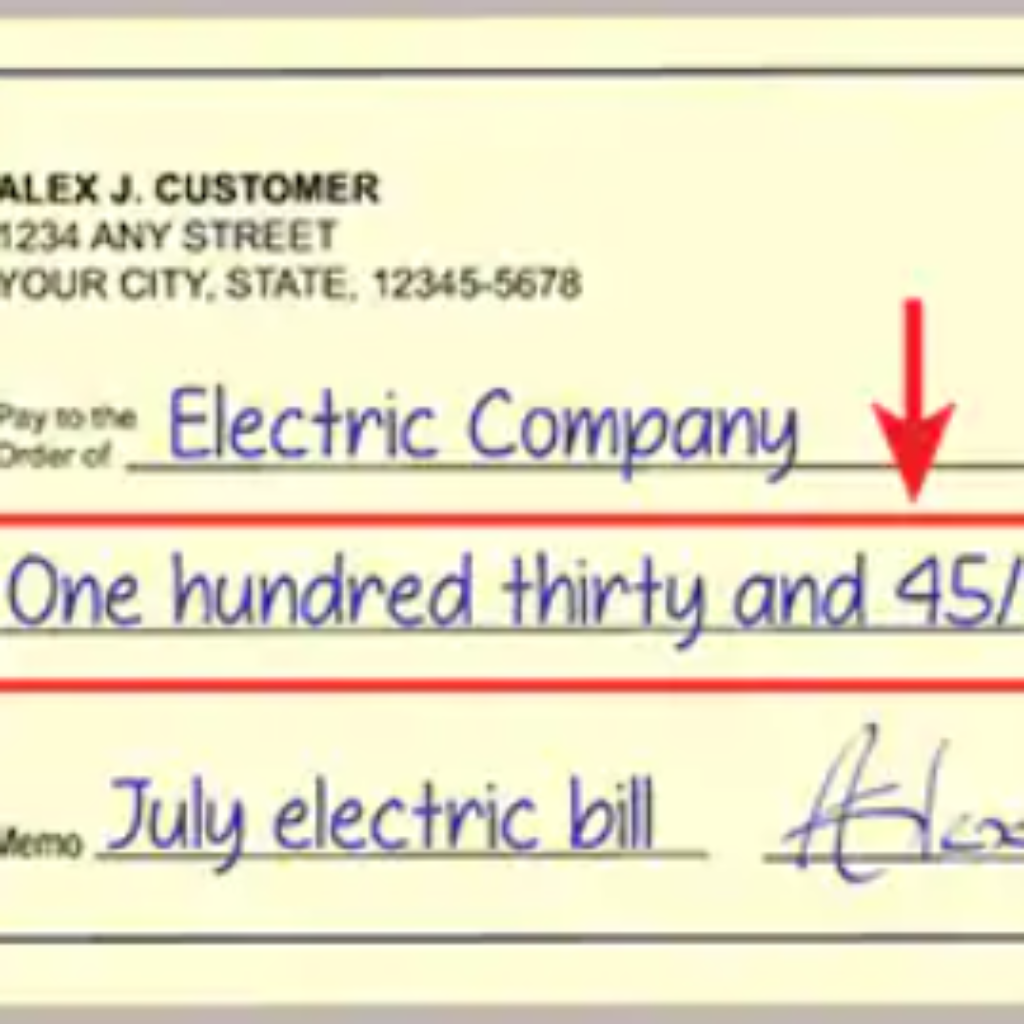

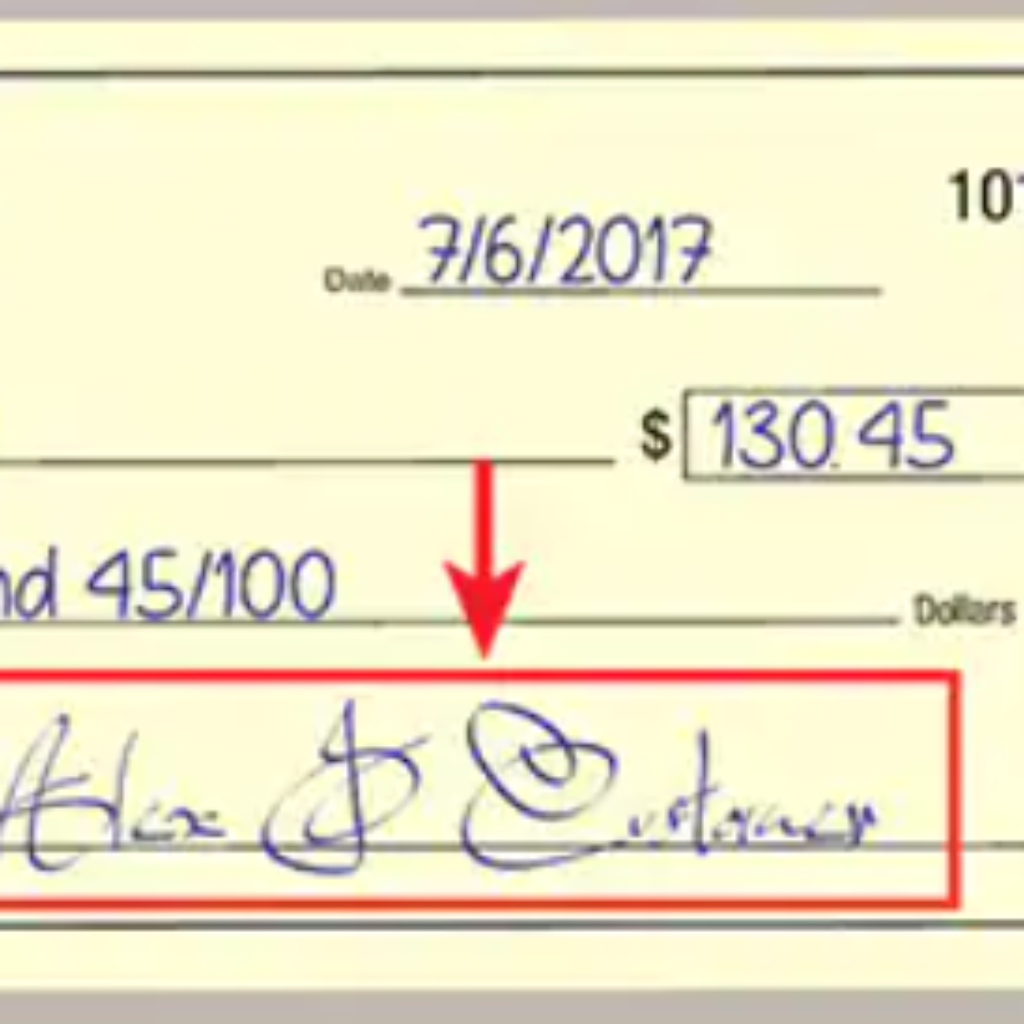

Writing the amount in words

Express the amount in words in the given line. Check each word’s accuracy and spelling again. Write the monetary amount in words on the line beneath “Pay to the order of,” matching the amount you typed in the box. When paying $130.45, for instance, you would write “one hundred thirty and 45/100.” Make sure to put the cents amount over 100 when writing a check with pennies. Include “and 00/100” nonetheless if the quantity is a round figure for further clarity. For a bank to execute a check, the dollar amount must be written down since it verifies the correct payment amount.

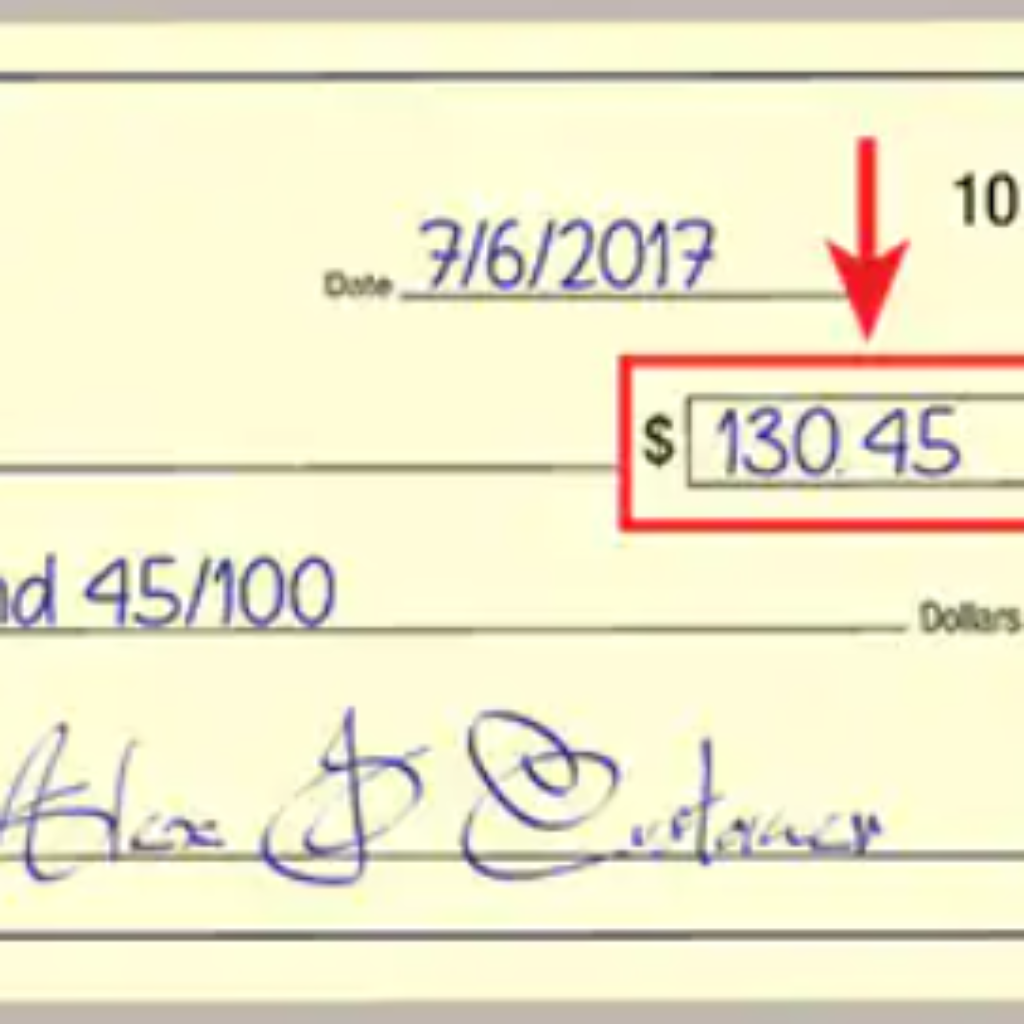

Adding amounts to figures

Type a numerical amount in the box next to the recipient’s name. Be careful with decimal points and zeros.

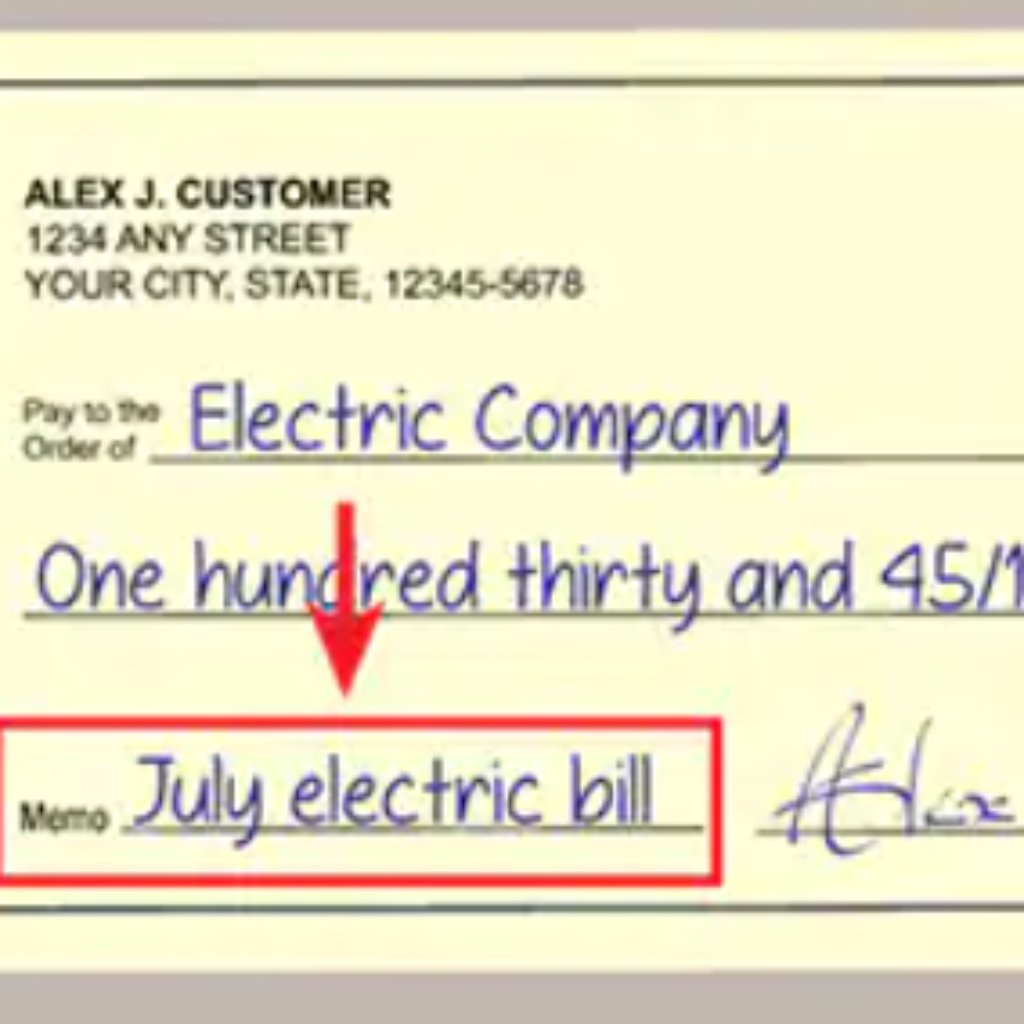

Memo and signature

If necessary, add a memo to specify the purpose of the payment. Sign the check at the bottom right to complete it. Your signature validates the cheque.

Common Mistakes to Avoid

Ignoring date fields

Forgetting the date of your check may result in processing delays or rejection by the payee’s bank.

Wrong payment

Discrepancies between written and numerical amounts can cause confusion and payment problems.

Signature errors

Missing or inconsistent signatures may invalidate the check. Verify that your signature and the one that is on your bank’s records match.

Why do checks still matter?

In an era dominated by digital transactions, checks provide a solid and secure payment method. The paper trail they provide can be valuable for record keeping and financial tracking.

Security Features

Checks often come with security features like watermarks and unique patterns, making them less susceptible to fraud than digital transactions.

Tips for Secure Check Writing

Using Gel Pen for Clarity

Choose a gel pen with black or blue ink for legible and clear writing.

Storing checks in a safe place

Keep your blank checks in a safe place to prevent unauthorized use.

Reconcile your checkbook regularly

Maintain a balanced checkbook by comparing your recorded transactions to your bank statements.

How to deposit a check

If you receive a check, depositing it is a straightforward process.

ATM for check deposit

Many ATMs allow you to deposit checks directly into your account. Follow the on-screen instructions for a hassle-free deposit.

Mobile banking options

Explore your bank’s mobile app, which often includes a feature to deposit checks by simply capturing an image.

Conclusion

Mastering the art of check writing is about more than a reminder of the past; It is a practical skill that continues to play a role in our modern financial landscape. By following these simple steps and being mindful of common mistakes, you can write checks with confidence and accuracy.