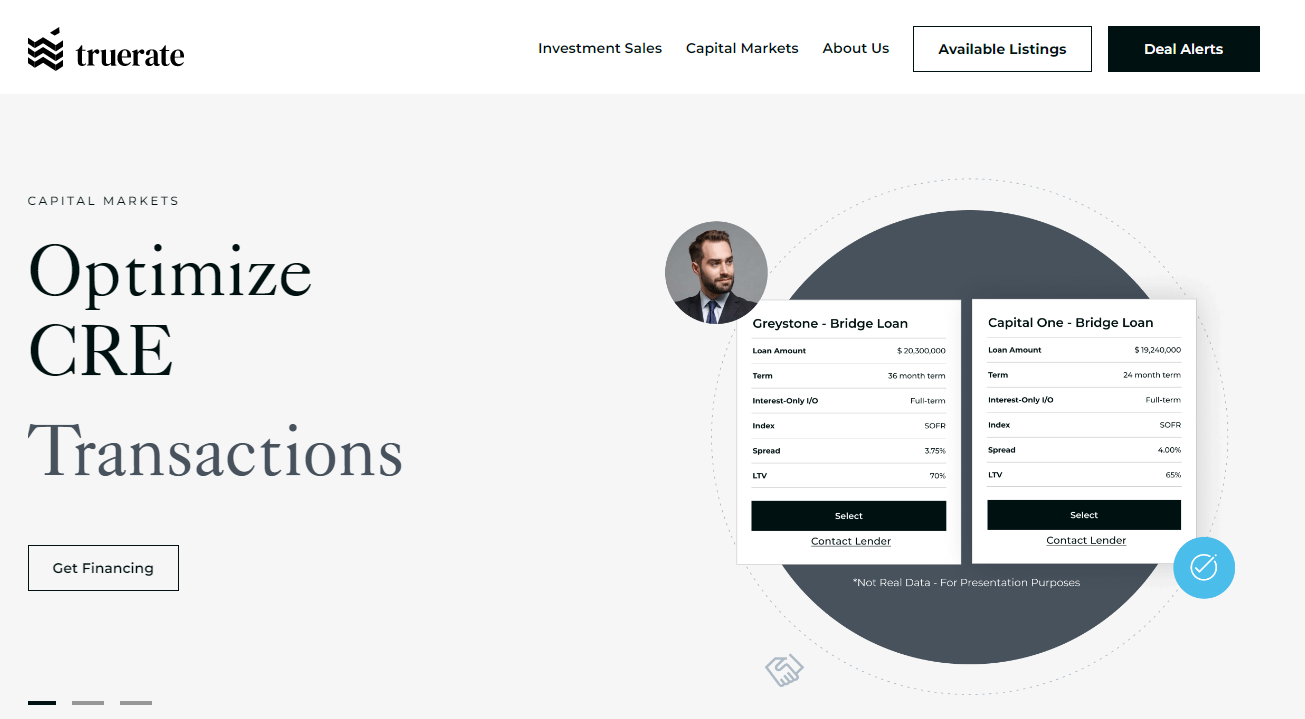

Commercial Loan Truerate Services: Commercial loans are a vital source of funding for businesses, particularly in the real estate sector. One of the key players in this industry is TrueRate, a company that specializes in providing commercial loan services to businesses and investors. TrueRate focuses on providing loans for non-residential properties such as shopping malls and office spaces that generate revenue (CRE).

TrueRate is a relatively new platform that established itself in 2020 and has quickly become a household name in the business lending industry. It is considered a top-tier platform for funding for the real estate investment sector, known for its convenient debt repayment platforms that aid clients through the repayment process.

In this article, we will delve deeper into the services offered by TrueRate, such as the equity placement strategy which helps businesses to raise capital in the market and get a boost through much-needed capital or funds. We will also explore the benefits of working with TrueRate and how it can help businesses and investors secure the financing they need to grow and succeed.

About Truerate

Commercial loan TrueRate services provider that focuses on providing loans for non-residential properties such as shopping malls and office spaces that generate revenue (CRE), and established itself in 2020, known for its convenient debt repayment platforms that aid clients through the repayment process.

It’s important to note that the information provided by the web search results should be verified and evaluated before making any decision.

Benefits of Commercial loan TrueRate services

TrueRate provides several benefits to businesses and investors when it comes to commercial loans, such as:

- Wide Network of Lenders: TrueRate has a large network of lenders which can help businesses find the perfect loan for their needs.

- Fast Approvals: TrueRate claims to offer fast approvals, which can help businesses secure funding quickly and efficiently.

- Easy Customer Service: TrueRate claims to offer easy customer service, which can make the process of obtaining a loan less stressful for businesses.

- Equity Placement strategy: TrueRate provides an Equity placement strategy that helps businesses to raise capital in the market and get a boost through much-needed capital or funds.

- Convenient debt repayment platforms: TrueRate claims to provide convenient debt repayment platforms that aid clients through the repayment process.

Services Provided By TrueRate

TrueRate provides a variety of services related to commercial loans. Some of the services provided by TrueRate are:

- Loan origination: TrueRate can help businesses apply for and secure commercial loans from a variety of lending partners.

- Loan comparison: TrueRate compares the different loan options available for businesses to help them find the most cost-effective financing solution for their needs.

- Interest rate calculation: TrueRate calculates the annual percentage rate (APR) of commercial loans, taking into account all of the costs associated with the loan, including the interest rate, origination fees, closing costs, and other charges.

- Creditworthiness assessment: TrueRate assesses the creditworthiness of borrowers and the financial stability and performance of businesses before approving a loan.

- Repayment options: TrueRate offers flexible repayment options, such as interest-only payments or balloon payments to help businesses manage their cash flow.

- Collateral assessment: TrueRate evaluates the value of any collateral offered as security for the loan, and advises borrowers if they need additional collateral.

- Customer support: TrueRate provides a dedicated customer support team to assist borrowers with their loan applications and any other queries related to the loan.

- Ongoing support: TrueRate provides ongoing support to borrowers throughout the loan term to help them manage their loans and make timely payments.

- Refinancing: TrueRate can help businesses refinance their existing commercial loans with a more favourable interest rate and terms.

Pros and Cons of Truerate Services

Pros

- Clear and accurate calculation of the annual percentage rate

- Fixed interest rates

- Flexible repayment options

- Range of loan options

- Dedicated customer support team

Cons

- Limited Information

- Hidden Fees

- High Interest Rates

Also Read: The Top Online Apps and Tools for Teaching

FAQs: Commercial Loan Truerate Services

Who can apply for a commercial loan?

Businesses of all types and sizes can apply for commercial loans, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations.

What are the requirements to qualify for a commercial loan?

The requirements to qualify for a commercial loan can vary depending on the lender and the type of loan.

Generally, lenders will look at factors such as the creditworthiness of the borrower, the financial stability and performance of the business, and the value of any collateral offered as security for the loan.

How long does it take to get approved for a commercial loan?

The approval process for a commercial loan can take several weeks to several months, depending on the lender and the complexity of the loan. It’s important to ensure that all the required documentation is provided in a timely manner to speed up the process.

How is the interest rate on a commercial loan determined?

The interest rate on a commercial loan is determined by a variety of factors, including the creditworthiness of the borrower, the financial stability and performance of the business, the loan amount and the type of loan, as well as the lender’s own risk assessment.

Conclusion- Commercial loan TrueRate services

In conclusion, TrueRate commercial loan services provide a valuable resource for business owners looking to secure financing. By offering transparent and competitive interest rates, TrueRate helps borrowers make informed decisions about their loans and ensures that they are getting the best deal possible.

Additionally, the company’s streamlined application process and quick approval times make it easy for borrowers to access the funds they need to grow their businesses. Overall, TrueRate’s services are a great option for any business owner in need of commercial loan financing.